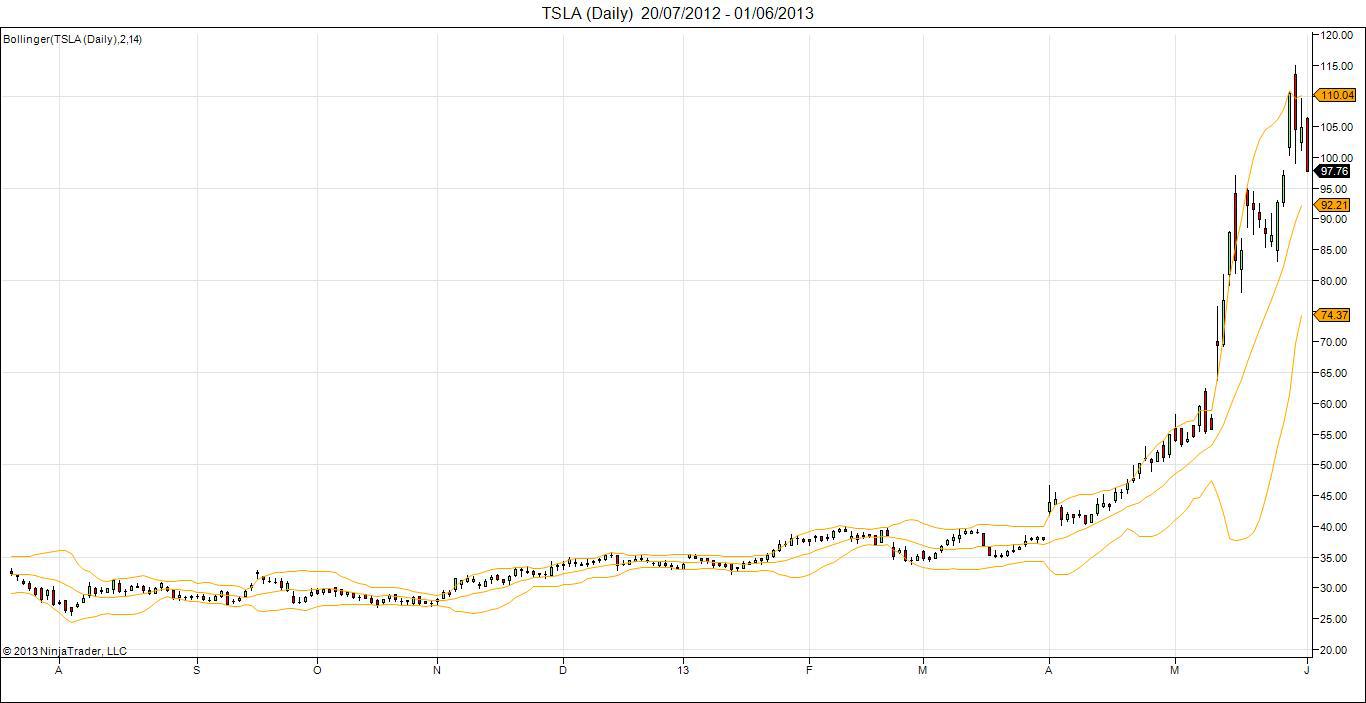

The history of German automakers Porsche and Volkswagen had been interlocked for many years, with Porsche owning a minority stake in Volkswagen. Past performance does not predict future returns. 1 September 2008 to 1 December 2009 in euros. The stock more than quadrupled in price in just four days Short squeeze 1: Porsche Volkswagen: ‘the mother of all short squeezes’Įxhibit 1: When short interest exceeds available stock We will look at each of these and the impact and learnings from these unusual but significant market events. Over the past 15 years, the Diversified Alternatives Team has experienced multiple shock events in stock and commodity markets, including three well-documented short squeezes.

Anatomy of three short squeezes (and lessons learnt) This, along with the technical complications of borrowing securities and managing margin calls, makes short selling a complicated undertaking, far from being just ‘longs with a negative holding’. On the short side, as the price rises, the position gets larger, and the problem also grows, dangerously so if the price rise is big or fast, as it is in a short squeeze. If a long position underperforms, the problem shrinks as the price falls and the position reduces in size. While losing money on both longs and shorts is painful, what makes short positions additionally risky is the fact that – other than in highly unusual situations – losses on longs are limited by the value of a share falling to zero, whereas losses on shorts are unlimited. A catalyst that triggers the price rise.

An imbalance in liquidity at the time that the short position is being covered.Highly sensitive/leveraged short sellers who need to buy back stock as it rises.He who sells what isn't his'n, must buy it back or go to pris'n." - Daniel Drew, American financier What is a short squeeze?Ī short squeeze is defined as a sudden, dislocated increase in the price of a commodity or security resulting from an excess of short selling that needs to be unwound.Ī number of underlying preconditions are necessary for a short squeeze to occur: Drew was reported to have lost US$500,000 at the time. However, he faced off against motivated, well-funded buyers, who were able to force the price up significantly. Drew shorted stock in the New York and Harlem Railroad Company in 1864, hoping to gain from a price fall. One of the better known and early short squeezes involved the speculator Daniel Drew, who was active on Wall Street from 1840 to 1875, and Cornelius Vanderbilt, a stalwart of Wall Street and early investor in railroads (among other businesses). Short squeezes have been an impactful feature in financial markets over the last two centuries, often occurring at times of broader market dislocation. This article will look at three instances of short squeezes over the last 15 years, all of which we have experienced – in one way or another – as a team, and the lessons we have drawn from each.

While uncommon, short squeezes manifest over time in different markets, and while the impacts vary, the causes are similar. It highlighted a rare but dramatic market dislocation known as a short squeeze. The announcement by Elliot Investment Management on 6 June 2022 that it is seeking US$456 million in damages(1) from the LME (London Metal Exchange) has brought attention back to the debacle in the nickel market, which saw the market effectively cease trading for two weeks in March(2).

0 kommentar(er)

0 kommentar(er)